Dwarka Expressway Boosts Gurgaon Real Estate

The Dwarka Expressway cuts the travelling time from Gurgaon to Delhi by as much as 30 minutes. This increased connection has transformed the highway into a doorway to hitherto unachievable property and infrastructure investments. The road, ideally situated within two smart cities and complete with several modern facilities, is set to alter both regions’ property sectors, raising prices for homes in Gurugram and Delhi.

The government of Haryana has several hopeful objectives for the Dwarka Expressway area including the creation of a “Skyscraper City” similar to international megacities such as Dubai and Tokyo. The future Global city endeavour, which covers 1000 acres in sectors 36 and 37, will include housing, business, institutional, and leisure hubs. This complete growth intends to suit global corporations’ demands while also creating a lively ecology.

Compliance to laws and regulations is critical for these premium home initiatives, as it ensures excellent development and building norms. Building laws, environmental restrictions, and security measures are strictly enforced, providing purchasers and developers with peace of mind and developing an excellent track record for luxury property in the area.

The marketplace worth of property close to the Dwarka Expressway has increased significantly. Over the previous ten years, housing costs for developments close to the highway have increased by 83%. Roughly 80% of the units introduced at this time have since been purchased. The focus is squarely on this area, and investigating several property lot choices to present the finest offers. The Dwarka Expressway’s attraction is further enhanced by its closeness to several corporate areas, such as Cyber hub and Aerocity. These centres draw in outside capital, which encourages the development of new business spaces and boosts the local economy.

Over the course of the next two to three years, real estate prices are predicted to increase by 20 to 40%, providing current homeowners with substantial financial returns.

The highway encourages thriving businesses as well as being situated near important destinations like IGI Airport, the International Convention Centre Dwarka, and the rest of Delhi-NCR. Numerous homes, economic hubs and retail centers have been built around the highway, benefiting relatively peaceful towns and easing traffic in large portions of the NCR region.

In addition, there is a significant demand for homes in the Delhi-NCR micro market. Now that the highway is running, tariffs are expected to increase by 10% to 15% in the upcoming months. The area’s housing environment is currently being redefined by a number of well-known builders. There is a wide range of options available from luxurious to reasonably priced housing along the route.

The Dwarka Expressway has transformed the neighbouring communities into thriving property centres and significantly improved their property possibilities. The highway is able to attract ventures, spur commercial expansion, and provide new opportunities for entrepreneurs and investors because of its outstanding facilities, enhanced accessibility, and favourable location. As it grows, the neighbourhood appears to be a major NCR property centre, with robust property industry development and growth anticipated.

2024 Property Trends: Price Spikes in Delhi, Noida, Gurugram, Bengaluru, and Mumbai

India’s real estate market is always evolving with more opportunities unveiling themselves now and then. 2024 has brought about a remarkable transformation, particularly in the premium residential segment. Major cities such as Delhi, Noida, Gurugram, Bengaluru, and Mumbai are witnessing an unprecedented surge in the prices of under-construction properties.

According to a recent report by global property consulting firm Savills India, these cities have seen price hikes of up to 53% as of June 2024, with Gurugram leading the charge. This surge is not just confined to under-construction properties; completed projects have also become much coveted, suggesting a strong and sustained demand in the housing market. This price trend is garnering the attention of investors and homebuyers alike, hinting at a wave of flourishing investments in the premium housing market.

Price Trends of 2024

Gurugram: Acing the Game

Gurugram is top-ranked in this price surge and the data is mind-blowing. The under-construction properties witnessed a surprising price increase ranging from 13% to 53%. This dramatic rise reflects the city’s growing appeal and the significant investments flocking into the real estate sector. Notably, completed projects in Gurugram have also seen prices rise by up to 44%, further establishing it as a top real estate destination.

Top Players on the List

Other cities are not far behind in this trend. Let’s look at the numbers from Noida that follow closely to those of Gurgaon, with under-construction property prices rising between 19% and 43%. North Goa has also experienced a significant price jump, ranging from 16% to 36%. Mumbai and Bengaluru have witnessed price increases of 1% to 21% and 5.2% to 11.5%, respectively, in their under-construction properties. In terms of completed projects, North Goa stands out again with a price increase of 16% to 36%, followed by Delhi with a rise of 3% to 27%. Bengaluru and Mumbai have seen more modest increases, with prices going up by 3.2% to 7.5% and 1% to 7%, respectively.

Factors Driving the Price Trends

Strong Market Demand

Savills India points out that the continued upward movement in prices indicates a strong demand in the premium housing market. The Reserve Bank of India (RBI) has maintained interest rates for the sixth consecutive time, which is expected to further boost the residential market. This stable interest rate environment has created a conducive atmosphere for both investors and homebuyers, driving up demand and, consequently, prices.

Investor and Buyer Trends

The market trends show that investor interest is gravitating towards new launches, while end-users are seeking ready-to-move-in properties. This shift in preference is quite logical as it suits the purpose of the property buyers. The trend is evident in the increased demand for older developments in grade-A corridors, which have seen a spike in interest from both buyers and tenants.

During the first half of 2024, buyer sentiment was particularly upbeat. Investors were keen on new launches, while end-users focused on properties that were ready for immediate occupancy. The demand is substantially higher for villas and apartments with large balconies and green patches, highlighting a preference for spacious and greenery in the enclave.

Luxury Segment and Sustainable Living

The luxury segment has also seen notable trends, with increased attention to the 4-bedroom format in both primary and secondary markets. This reflects a growing appetite for more luxurious and spacious living arrangements. Additionally, there has been a significant rise in new launches in Gurugram and Delhi, further indicating a strong demand for luxury residences.

In the first half of 2024, the buyer sentiment was extremely positive, with a clear division between investor interest in new launches and end-user preference for ready-to-move-in properties. The older developments in grade-A corridors have seen increased demand from both buyers and tenants, highlighting the multi-utilitarian natrue of the location.

There is a growing demand for upscale, sustainable living. Buyers are now seeking green buildings that offer sustainable living options beyond traditional amenities. This shift towards nature-centric properties reflects a broader trend towards nature-conscious living and a desire for high-quality and sustainable housing.

Conclusion

As it is apparent, the significant price increases in both under-construction and completed properties across major Indian cities point towards a thriving real estate market. The other factors in the market like the strong demand, stable interest rates, and growing preference for luxury and sustainable living options are signalling a positive growth trajectory. As the market continues to evolve, these trends provide valuable insights for investors and homebuyers looking to navigate the complexities of India’s real estate landscape.

Gurgaon Real Estate: How Dwarka Expressway is Transforming the Landscape

The Dwarka Expressway is a transformative infrastructure project reshaping the future of Gurugram. With the promise of improved accessibility and enhanced connectivity, this expressway has sparked a significant surge in Gurugram’s real estate market, catching the attention of homebuyers and investors alike. This development is pivotal in transforming Gurugram into a vibrant urban centre and a key player in India’s real estate sector.

Economic and Real Estate Impact

The introduction of the Dwarka Expressway has fueled economic growth and boosted infrastructure development in the region. Property values along the corridor have seen a substantial increase, reflecting the growing interest from both domestic and international markets. This surge in activity underscores Gurugram’s emergence as a prime destination for real estate investment. The expressway’s completion is anticipated to further drive economic activities, catalysing job creation and enhancing the overall liveability of the area.

Connectivity and Infrastructure Enhancements

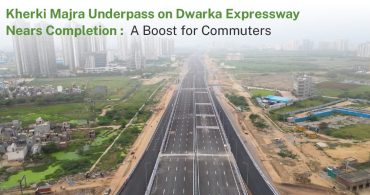

One of the most significant advantages of the Dwarka Expressway is its ability to enhance connectivity between Delhi and Gurugram. The central peripheral road, acting as a crucial connector, links the Dwarka Expressway to Sohna Road via the Southern Peripheral Road (SPR). This strategic infrastructure is vital in maintaining the growth momentum of Gurugram. Prime Minister Narendra Modi’s recent inauguration of the Haryana section of the expressway is expected to streamline traffic flow and alleviate congestion, making commutes more efficient and reducing travel times significantly.

A New Residential Hotspot

The Dwarka Expressway-New Gurgaon corridor has rapidly become a sought-after residential destination. Over the past decade, approximately 53,000 housing units have been introduced in the area, with more than 80% already sold. This high demand has driven up property prices, with average rates increasing from Rs 4,530 per square foot in 2013 to Rs 8,300 per square foot by the end of the previous year. Esteemed developers have launched numerous projects in the vicinity, solidifying its status as a top choice for homebuyers and real estate investors.

Key Sectors and Areas Along the Expressway

The Dwarka Expressway traverses several key sectors in Gurugram, including Sectors 113, 112, 111, 110, 109, 108, 107, 106, 104, 103, 102, 99, 88B, 37D, 36A, and 36B. Its catchment area extends from Sector 81 to 115, connecting crucial areas such as Manesar Road and Pataudi Road. Additionally, it provides linkage to the Delhi Mumbai Expressway, further enhancing its strategic importance. As the Haryana stretch of the expressway nears completion, developers are optimistic that their investments will yield significant returns, with approximately 150 residential projects already delivered along this corridor.

Anticipating Future Growth and Development

The completion of the Dwarka Expressway is expected to bring about profound economic changes, steering Gurugram’s development in a positive direction. This infrastructure project underscores the monumental role of connectivity in catalysing growth and prosperity. As the expressway opens up new avenues for investment, Gurugram is poised to become a benchmark for sustainable urban development and economic success in India.

The ripple effects of this infrastructure project are anticipated to be far-reaching. Increased economic activity, job creation, and enhanced liveability are just a few of the benefits that the region is set to enjoy. With the promise of improved accessibility and enhanced connectivity, the Dwarka Expressway is all set to unlock significant opportunities for businesses, residents, and investors alike. As Gurugram ventures into this path of profound change, it is primed to showcase its potential as a dynamic and vibrant economic hub, driving innovation, growth, and prosperity for years to come.

In conclusion, the Dwarka Expressway is spearheading a real estate renaissance in Gurugram. Its impact on the city’s economic and infrastructural landscape is undeniable, making it a crucial development for anyone interested in the future of urban growth and real estate investment in India.

5 Best Rental Markets for IT Professionals in Bangalore

At the heart of all economic growth in Bangalore are hardworking IT professionals who drive the engines of the city. Thus, neighbourhoods popular among IT professionals are either already established hotspots or in the process of becoming one. From the high-rise apartments in Bellandur to the upscale homes in Whitefield, we examine five property hotspots preferred by tech workers. Each area offers unique benefits, catering to the diverse needs of Bengaluru’s dynamic workforce. Read along to get a full comparison of the top 5 micro-markets based on location, infrastructure, and rental yield.

Electronic City:

Main Advantage – New Airport to Transform the Location

Infrastructure development transforms the rental prospects of the location. Recently, Tamil Nadu Chief Minister MK Stalin announced the construction of a new airport in Hosur. This development is set to bring significant benefits to Bengaluru’s Electronic City, located just 25 kilometres away from Hosur. For tech professionals living and working in this tech hub, the new airport ensures convenient travelling and reduces commuting times significantly. Currently, the commute from Electronic City to Kempegowda International Airport, situated over 60 kilometres away, can take anywhere from one to three hours. The new airport in Hosur is expected to offer a much-needed alternative, potentially easing the strain on Bengaluru’s existing airport and providing faster connectivity for residents of Electronic City.

Rental Trends

Electronic City, one of South Bengaluru’s major tech hubs, has seen significant rental growth over the past year. Rentals have increased by 10-15% year-on-year, driven by high demand from tech professionals. The area offers a range of housing options, from apartments to paying guest accommodations. A 2 BHK property in Electronic City is currently available at an average rental value of ₹28,000. Despite the presence of a lot of unsold inventory, the demand for rental properties remains strong. Kiran Kumar, vice president at Hanu Reddy Realty, noted that the presence of several paying guest accommodations is eating into the share of apartment landlords, which has kept prices relatively competitive compared to other areas.

High Demand in Bellandur

Main Advantage – High Demand and Prime Location

Bellandur, located in South East Bengaluru, has become one of the most sought-after neighbourhoods for tech professionals. Bounded by Sarjapur Road and HSR Layout, Bellandur is home to several corporate giants such as Intel Technology, LinkedIn, Adobe India, and Wells Fargo. Like every well-developed locality, Bellandur offers smooth connectivity and easy access to social amenities.

Rental Trends

The presence of these major companies has driven up demand for housing in the area. The average rent for a 2 BHK apartment in Bellandur is around ₹40,000, reflecting a 20% increase over the past year. This surge in rental prices is attributed to a supply crunch and the unavailability of sufficient land parcels for new projects. Despite the high costs, the area remains highly desirable due to its strategic location and robust mix of modern apartments and gated societies developed by real estate majors like Prestige Estates, the Embassy Group, and Sobha Ltd. Additionally, several co-living brands have established a presence in Bellandur, catering to the growing demand from young professionals.

Whitefield’s Upscale Market:

Main Advantage – Luxury, Community & Metro Connectivity

Whitefield, situated on the eastern periphery of Bengaluru, is known for its upscale IT and residential hubs. The area has attracted numerous real estate developers, resulting in a wide range of housing options.

Rental Trends

Average residential property prices in Whitefield are around ₹10,850 per square foot, making it one of the pricier areas in Bengaluru. A 1 BHK flat in Whitefield can cost between ₹46.25 lakh and ₹87.50 lakh, with fully furnished units commanding average rentals of ₹28,000. For a 2 BHK, the rent is approximately ₹35,000. The recent operationalization of the Purple Line metro in March 2023 has further boosted Whitefield’s appeal, causing rents to increase by 7-10%. Major real estate brands like Godrej Properties, Prestige Estates, Sumadhura Group, and Sobha Ltd. have multiple projects in Whitefield, offering a blend of luxury and convenience that appeals to tech professionals and their families.

Marathahalli:

Main Advantage – Affordable Housing in Vicinity of IT Hubs

Marathahalli, located on the Outer Ring Road in East Bengaluru, is another preferred residential locale for techies. Its strategic proximity to Whitefield, just 8.6 kilometres away, makes it an attractive choice for professionals working in the IT sector. The region is high indemand owing to the location as well as the afoordable options for resideces. It is a bachalor’s hub and hold strong rental potential.

Rental Trends

The average rent for a 2 BHK apartment in Marathahalli is around ₹32,000. Property prices have appreciated by 10-15% annually, reflecting the high demand for housing in the area. According to data from 99acres, the current average property transaction rate in Marathahalli is ₹9,151 per square foot. However, a local broker pointed out that there is limited land available for upcoming projects, which could pose challenges for future development. Despite this, Marathahalli remains a popular choice due to its excellent connectivity and proximity to major IT hubs.

Emerging Hennur

Main Advantage – Most Sought-After in North Bengaluru

Hennur, located in North Bengaluru, has gained prominence as a preferred residential area for tech professionals, especially after the COVID-19 pandemic. Situated just 6 kilometres from the popular Manyata Tech Park, Hennur offers a convenient living option for IT employees.

Rental Trends

Property prices in Hennur have appreciated by 10-15% over the last year, reflecting the growing demand for housing in the area. A 950-1,200 square foot 2 BHK unit in Hennur rents for ₹32,300 to ₹40,000, while a 1,250-1,630 square foot 3 BHK unit commands a rental of ₹43,100 to ₹55,600. The average residential property rate in Hennur is ₹10,850 per square foot, according to data from 99acres. Additionally, Hennur’s proximity to Kempegowda International Airport, located 25 kilometres from Hebbal, adds to its appeal for tech professionals who frequently travel for work.

Hosur as a Residential Choice

Main Advantage – Affordable and Accessible

Hosur has emerged as a popular residential choice for many techies working in Electronic City. Known for its affordable housing options and quicker connectivity, Hosur offers a viable alternative to the more expensive and congested parts of Bengaluru. The city’s proximity to Electronic City makes it an attractive option for professionals looking to balance work and home life without enduring long and stressful commutes. Many tech employees find that they can get more value for their money in Hosur, enjoying spacious homes at a fraction of the cost compared to other parts of Bengaluru. This affordability, combined with the upcoming airport, is likely to make Hosur even more appealing to tech professionals in the future.

In conclusion, Bengaluru’s real estate market offers a variety of options for tech professionals, each with its unique advantages. Whether it’s the high demand and strategic location of Bellandur, the upscale market of Whitefield, the proximity of Marathahalli, the affordability of Electronic City, or the emerging prominence of Hennur, techies in Bengaluru have plenty of choices to suit their needs and preferences. As the city continues to grow and develop, these neighborhoods will likely remain at the forefront of Bengaluru’s dynamic real estate landscape.

Top 5 Reasons Why NRI Investors are Flocking to Gurgaon

Gurugram, the bustling city adjacent to New Delhi, is fast emerging as a preferred destination for NRIs seeking luxury living and lucrative investment opportunities. The city’s rapid growth and robust economy have established it as a magnet for professionals from around the globe. With major global firms establishing their presence here, the city offers a high-end lifestyle and the potential for profitable returns.

Luxury Realty in Gurugram: The Hub of the Expats

It is helpful to note the trends because they are pointing at the favourable investment opportunities opening up in the city’s landscape. For instance, property purchases in the real estate market have highlighted the interest the expats are showing in the high-end residential options. Exploring the factors that have enkindled this preference in overseas buyers can help figure out the most profitable investment opportunities that align best with the needs of interested buyers.

Infrastructure and Connectivity

One of the main attractions for expatriates is its strategic infrastructure and connectivity of Gurgaon. The city is seamlessly connected via major highways like the Delhi-Mumbai Industrial Corridor and Delhi-Gurgaon Expressway, facilitating easy travel within the National Capital Region (NCR) and beyond. Upcoming projects such as the Gurugram Metro and Rapid Rail Transit System are set to further enhance connectivity, promising a more convenient lifestyle for residents. The infrastructure in some areas is still in the developing stages but in the coming years by the time the position is granted for the properties, these semi-developed locations of today will be the commercial hubs of the future.

Expats’ Housing Preferences

Expatriates flock to Gurugram for its array of luxury condos and lavish villa mansions that redefine upscale living. Other cities in India either offer these leisures at a very high price or this segment is absent in the marketing segment, These residences offer state-of-the-art amenities such as advanced security systems, expansive green spaces, and exclusive club services. Additionally, the location is near top-notch tech parks and shopping destinations. Projects from developers like DLF, M3M India, and Central Park exemplify the city’s appeal, with nearly 30% of their residents hailing from overseas.

Economic Opportunities

Gurugram’s robust economic landscape, dominated by sectors like IT, banking, and real estate, serves as a significant draw for expatriates seeking career advancement. The city’s thriving job market and proximity to global corporate hubs make it an ideal choice for professionals looking to further their careers while enjoying a high standard of living. These areas are great options for those investors who are interested in renting or selling since the rental and appreciation rates in good localities are quite high. Areas such as DLF Phase 1-5, Golf Course Road, and Sohna Road are particularly favoured for their strategic location and comprehensive amenities, catering perfectly to the needs of NRI families.

A Complete Package

Beyond its economic prowess, the city offers a well-rounded social infrastructure that includes renowned international schools, world-class hospitals, and vibrant entertainment options. The city’s southern and western regions, including Southern Peripheral Road and Golf Course Road, are witnessing increased popularity due to their excellent amenities and connectivity. These areas not only provide comfortable living spaces but also ensure easy access to essential services and recreational facilities.

Recreational Luxury

For sports enthusiasts, Gurugram stands out with its selection of elite golf courses such as Karma Lakelands and DLF Golf and Country Club. These world-class facilities selectively cater to the preferences of those with a penchant for ultra-luxury. The exclusive lifestyle is the city’s allure as a premium residential destination. The availability of such recreational options enhances the overall experience for residents accustomed to a global standard of living.

Continued Trajectory of Growth

Looking ahead, Gurugram is expected to pave the way ahead as a leading destination for NRI investments. With ongoing infrastructure developments and a growing emphasis on sustainable urban planning, the city is set to establish its reputation as a hub of economic activity and high-quality living. Expats choosing Gurugram is an addition to the cultural diversity while it poses to be the key player in the economic growth story, shaping a dynamic and urban residential market that is all set to rival global standards.

In conclusion, Gurugram’s allure for expats lies in its perfect blend of career opportunities, luxurious living spaces, and vibrant community life. As more professionals from around the world choose Gurugram as their home, the city continues to evolve into an investment goldmine within India’s realty landscape.

Dwarka Expressway: Key to the Expanding Real Estate Market in Gurugram

Gurugram, a bustling city in the National Capital Region (NCR), with a rapidly growing tech industry market, is undergoing a transformative phase from the realty standpoint. This progress can be accredited to many factors such as the influx of working professionals and favourable renting prices over a few decades. However, the most recent surge can be majorly credited to the most awaited infrastructure development – Dwarka Expressway.

The Dwarka Expressway can be deemed as the third crucial connecting link between Delhi and Gurgaon, just as NH-8 and Mehrauli-Gurgaon Road pump life into the city. This 29-kilometre stretch of road has emerged as the key to economic growth, job creation, and an expanding real estate boom, positioning the city as the epicentre for a lucrative investment opportunity.

Spanning 18.9 km in Gurugram and 10.1 km in Delhi, this 16-lane access-controlled highway from Shiv Murti to Kherki Daula is an exemplary product of modern engineering brilliance. It features an 8-lane grade-separated route, three-lane service roads, numerous underpasses at intersections, and multi-level interchanges for the convenience of the commuters. The expressway drastically reduces the time needed to travel between the two cities.

Further, the strategically located expressway offers direct access to the upcoming India International Convention Centre (IICC) in Dwarka’s Sector 25 and an alternate route to IGI Airport via an 8-lane tunnel. It ensures seamless connectivity to Bijwasan railway station, NH-8, and Southern Peripheral Road (SPR). Planned developments include a new interstate bus station and urban forests using the Miyawaki technique, enhancing greenery with 30 times denser and 10 times taller plantations. Thus, making it an attractive corridor for future growth and development.

Real Estate Transformation

The Dwarka Expressway has triggered a remarkable increase in real estate development over the past decade. More than 53,000 housing units have been introduced along its corridor, and the success is apparent from the impressive 80% sale that has already been accounted for in the region.

The rise in demand has consequently spiked the property prices making the area a highly coveted residential destination, appealing to the home buyers seeking modern living spaces. The proof of the significantly positive price surge is the trend observed in the region where property prices rose by 41% from 2020 to 2023 along the Dwarka Expressway. This upward trend highlights the area’s growing popularity among investors and homeowners alike, drawn by its modern infrastructure and promising investment potential.

The striking appreciation in property values shows that property buyers see it as an attractive and lucrative investment. The prime real estate destination awaits further appreciation, making it a perfect time to invest in the market.

Sustainable Urban Development

Situated near the Indira Gandhi International (IGI) airport and seamlessly connected to major cities like Delhi and Jaipur, the Dwarka Expressway has positioned Gurugram as a facilitator for businesses and industries. This strategic location has attracted new ventures leading to job creation across sectors like construction, logistics, and hospitality. The improved accessibility has further amplified Gurugram’s appeal as a commercial hub.

Beyond connectivity, the Dwarka Expressway prioritises sustainable urban planning. Green corridors and landscaped areas integrated along the expressway contribute to a healthier environment, enhancing the overall quality of life for the residents. Renowned builders are launching integrated townships incorporated with essential amenities like schools, hospitals, and shopping centres to promote a sustainable living environment. It reflects a thoughtful approach to development that balances growth while incorporating environmental conservation methods.

Future Prospects

Looking ahead, Gurugram is ready to accomplish feats with sustainable and economic urban development in India. The ongoing development of the Dwarka Expressway promises to unlock even greater opportunities, through connectivity, and residential appeal in the region. As infrastructure continues to evolve and expand, Gurugram’s transformation into a dynamic urban centre is set to attract more investments, businesses, and residents seeking a vibrant and prosperous living environment.

The Haryana section of the infrastructure milestone was recently inaugurated by Prime Minister Narendra Modi, highlighting the importance of the project and marking the significant leap forward in Gurugram’s infrastructure. It aims to alleviate traffic congestion and boost activities by enhancing connectivity between Delhi and Gurugram. The arterial link between the two cities has established itself as a transformative force driving Gurugram’s evolution towards a flourishing future.

The impact of impact on real estate, economic growth, and sustainable development is apparent in underlying the significant role it has in shaping the future of the Delhi-NCR region.

Is India Ready for the Era of Ultra-Luxury Properties?

In recent years, India’s real estate landscape has witnessed a remarkable surge in the demand for uber-luxury homes, it is primarily driven by a booming segment of enthusiastic buyers seeking grand living spaces. The homebuyers have shown a striking bend of interest towards luxury living options and the developers are keen on providing living spaces that scream luxury.

Let us look into some trends and developments that have lately emerged in the market and are shaping this upscale market and driving the demand for the projects.

Evolving Market Trends:

Increased sales by a whopping 75% Last Year

India is growing at a rapid rate and the demand for luxury properties. Affordable luxury is a new segment arising owing to the changing trends. However, this blog is centred around the high-end luxury big-ticket projects that offer a whole new world for the residents.

2023 marked a significant milestone for India’s luxury real estate market. The sales of homes valued at Rs 4 crore and above have increased handsomely by over 75%. This dramatic increase has effectively doubled the share of total housing sales, bringing to light a rise in the demand amongst homebuyers for high-end residential properties across the country.

Promising Growth Patterns

Since the demand has been rising, Indian real estate developers have hopped on the bandwagon and strategically diversified their portfolios to include a range of projects that go beyond the norm and bring a world of luxury to life. The standard of living has improved and Indian developers are ready to bring the very best to the emerging market of lavish homes. Indian real estate has shown a striking rate of demand absorption for high-end luxury properties. Catching up in full swing, developers are launching exemplary big-ticket projects in cities like Delhi, Bangalore, Gurgaon, Mumbai and other important cities.

Indian Real Estate Firms Diversify to Meet Demand

The palatial projects in question are typically priced between Rs 3.5 crore and Rs 45 crore, and cater predominantly to the HNI investors likely to belong to the demographic of new-generation entrepreneurs and C-level executives who are increasingly seeking exclusive, amenity-rich homes as a statement of their success and lifestyle.

In 2023, a staggering 12,935 luxury homes were sold, a whopping increase from 7,395 homes in 2022. This significant increase in sales was complemented by a 45% rise in new luxury home launches, underlining the robust growth trajectory of the luxury real estate market. This is a first-of-its-kind instance.

Spotlight on Prestige Estate Projects and Concorde Group

Bengaluru-based Prestige Estate Projects has made headlines with its ultra-luxurious offerings. The Ocean Towers in Marine Lines, featuring 4-bedroom sea-view residences starting at Rs 23 crore, and the upscale Prestige Daffodils in Pali Hill, Bandra West, with homes ranging from Rs 26 crore to Rs 45 crore, have garnered significant attention and demand.

Anand Ramachandran, Senior Vice President of Business Expansion at Prestige Group, attributes this demand surge to India’s wealth creation among top executives and entrepreneurs post-Covid, coupled with the allure of spacious, high-end residences designed to international standards.

Concorde Group, focusing on prime locations like Basavanagudi and Koramangala in Bengaluru, offers luxury properties ranging from Rs 10 crore to Rs 30 crore for villas and Rs 3.5 crore to Rs 15 crore for duplexes. Anil RG, Managing Director of Concorde, underscores the premium nature of these properties, driven by exclusive specifications and prime locations that cater to discerning buyers.

Prestige, MAIA Estates, Ganga Realty, Runwal, and Casagrand at the Forefront of the Revolutionising Realty

MAIA Estates is expanding aggressively across Bengaluru and Chennai, with plans to introduce 3.5 million sq. ft. of residential projects and 1.5 million sq. ft. of high-end commercial spaces in the coming year. Founder and CEO Mayank Ruia highlights the success of their flagship projects like Pelican Grove and 27 Summit, where property values have doubled within a short span, attesting to the robust demand for luxury living.

Ganga Realty has embarked on an ambitious project in Gurugram, focusing on developing 30 lakh sq. ft. of ultra-luxury residences with an investment exceeding Rs 1,000 crore.

Meanwhile, Mumbai-based Runwal is enhancing its presence in the Mumbai Metropolitan Region with substantial investments in upscale developments like Worli and Walkeshwar, aiming for a 30% growth in investments in FY25.

Chennai-based Casagrand is poised to develop over 600 ultra-luxury units across prime locations, reflecting their strong commitment to meeting the growing demand for luxury homes in key urban centres.

Conclusion

As India’s economy continues to thrive and the number of high-net-worth individuals grows, the demand for luxury homes is set to escalate further. The real estate developers, with their strategic focus on upscale projects, are all set to take advantage of this trend, offering affluent buyers unparalleled living experiences in some of the country’s most sought-after locations. This surge in ultra-luxury housing not only mirrors economic prosperity but also reflects evolving consumer preferences for exclusive living spaces designed per the taste of the residents that redefine luxury in India’s real estate market.

Decline in Unsold Housing Inventory: A Positive Shift in NCR Real Estate

One of the most often used indicators of economic health and consumer sentiment in the real estate sector is unsold inventory. Delhi NCR in particular has been plagued with this issue due to unscrupulous practices by the industry’s stakeholders, speculation-driven growth, and oversupply, leading to often stagnation in the market. However, recent data from real estate consultants has shown a different and rather positive shift in the region’s market.

As per data, there has been a notable decline in unsold housing inventory in the Delhi NCR region, showing a remarkable decrease of a whopping 57% over the last five years. This paints an optimistic picture of the market’s health, one that depicts recovery and growth. Let us dig a bit deeper into this development and what it might mean for the market’s future.

Understanding the Decline:

Before delving into the decline and its potential ramifications, let us first understand the potential reasons beyond this shift. One of the major reasons that led to the decline is the gradual loosening of restrictions in the post-pandemic world, which has led to a noted revival of consumer confidence. Further, the vulnerabilities of global economics witnessed during the pandemic and the volatility of many asset classes have led to the emergence of trust in real estate as a stable asset class.

Another reason for the decline of unsold inventory is the agility and innovation with which many developers have recalibrated the housing landscape in accordance with changing customer demands. Therefore, many developers are now coming out with projects that are furnished with every possible luxury amenity while being conscious of their responsibility to the community and environment. Eco-luxury projects that are affordable are what consumers are drawn to today, and that is exactly what developers are bringing to the market. This alignment between supply and demand has contributed to the reduction in unsold inventory, particularly in cities like Gurgaon.

Regional Comparisons:

While the resurgence witnessed in the Delhi NCR housing market has been noteworthy, it must also be noted that it is not an isolated incident. While the decline in Delhi NCR has definitely been the highest, the housing markets of southern cities like Bangalore, Hyderabad, and Chennai have also witnessed an impressive decline of 11% during the same period. Mumbai Metropolitan Region (MMR), Pune, and Kolkata have also witnessed a decline, albeit at a varying and slower rate than the other cities mentioned.

Nonetheless, this decline has led to a resurgence in confidence amongst developers as well as increased demand for homes. A city in which this trend has been witnessed on a rather large scale is Millenium City, Gurgaon. Though the city currently stands out with the maximum unsold inventory—a colossal 33,336 units—it is key to notice the city has observed a 37% decline over the last 5 years. This showcases the resilience of the Gurgaon market and has instilled confidence amongst the buyers, further strengthening the region’s real estate potential.

However, the real success stories of Delhi NCR are the suburbs of Ghaziabad, Noida, and Greater Noida. The suburb of Noida has witnessed the largest reduction of unsold inventory, with a staggering 71% decline since 2018. This is followed by Ghaziabad and Greater Noida, both witnessing an impressive 70% reduction. This trend highlights how many people, especially the working class, are now more inclined to invest in suburban areas, away from the packed central hubs of the cities.

Controlled Supply Dynamics:

A key factor in keeping this positive momentum of reduced unsold inventory going is restraint when launching new projects and keeping supply additions under control. This change in approach to the residential real estate market is evidenced by the addition of new supply between Q1 2018 and Q1 2024, limited to 1.81 lakh units, ensuring more sustained growth and a balanced market.

Conclusion:

The decline in unsold inventory that Delhi NCR has witnessed is a testament to the resilience of the market and the confidence that consumers have in the region’s growth potential. The real estate landscape today is one characterised by resilience, stability, and sustained growth. Moving forward, to maintain this growth, collaboration between developers, policymakers, and financial institutions is the need of the hour. By focusing on fostering this ecosystem, Delhi NCR is right on track to be an opportune investment ecosystem for decades to come.

Pune’s Urban Expansion: Villages Inclusion to Fuel Housing Projects

Did you know that in 2024, the Indian economy will become the world’s fourth-largest economy? While a great feat, this achievement was a result of many factors, not the least being the increasing urbanization and consequently increased opportunities for the working demographic. However, the ever-increasing migration to the developed metropolitan cities of the country has put an amplifying amount of pressure on the existing urban infrastructure.

In such an ecosystem of burgeoning urban development, the expansion of city limits is often brought up and is more often than not contentious. An interesting proposal has been brought up by UCDR to expand Oxford of East Pune’s municipal limits. This is crucial because, in the last two decades, Pune has become one of the fastest-growing cities in the country. However, the infrastructure of the city has failed to keep up with the rapid increase in population and housing demand.

Therefore, this proposition couldn’t have come at a better time for the denizens of Pune. As detailed in recent news coverage by the Times of India, the proposal envisages certain villages around Pune being added to the city’s municipal limits. Not only will this benefit the city by helping address the extant problem of unplanned and oversaturated urban sprawl, but it will also provide innumerous benefits like providing affordable housing, addressing the issues of skyrocketing property prices, and many more.

Though this move might seem to be merely administrative at first glance, solely undertaken to accommodate the population boost, it is so much more. Indeed the proposal is also significant for the infrastructural development and socio-economic dynamics of the area. Let’s carefully consider some key effects that this proposal’s implementation might have:

- Addressing Urban Sprawl:

Did you know that the population of Pune has increased at the rate of 2.5% every year since the 1970s? While this can be looked at as an advantage for the city as most of this migration is of educated professionals and skilled labourers, contributing to the economic prowess of the city, it can also easily overwhelm the already strained infrastructure of the city.

Like many other metropolitan cities, the unplanned population boost and urban expansion has led to the city scrambling to deal with the crisis of urban sprawl. This is due to many reasons such as inefficient land planning, resource utilisation, lack of infrastructure, etc. This is precisely the reason why the proposal couldn’t have come at a more opportune moment for the city. The integration of villages in Pune’s municipal limits will allow administration to undertake the expansion in a much more planned and sustainable manner than ever before. Therefore, ensuring the region does not follow the extant pattern, steering for a better future for the upcoming generations. - Infrastructure Enhancement:

Another critical aspect which cannot be ignored when considering the proposal is infrastructural advantage the region would get from its implementation. The primary advantage that the proposal would beget is simply bolstering of the infrastructural network. This includes road, railways and other forms of public transport as well as water and sanitation frameworks. This is simply because extending the municipal boundaries enables the administrative authorities to structure,coordinate and invest in essential services in a streamlined manner.

An improvement in infrastructure of the area will lead to significant improvement in the standard of living of the residents here. Not only that, this is only likely to increase investment in the area, both commercial and recreational, further bettering the economic and social prospects of people living here, while also lowering pressure in mainland Pune. - Housing Affordability:

One of the most significant challenges faced by aspiring homeowners in Pune are that of increasing property prices and scarcity of good,affordable homes. In support of the proposal, CBRE stated that its implementation is likely to kick off a slew of residential development in this area. As supply of homes increases, the prices in this area are projected to belong to the affordable category, therefore providing much needed affordable housing avenues for Pune denizens.

Final thoughts..

As the above noted advantages make it clear, if the proposal to expand Pune’s municipal limits is indeed accepted, then it will unfurl a world of benefits for the city. As the city embarks on this journey to grapple the challenges of urban expansion while promoting economic progress and sustainability, it has provided a roadmap for other major cities in the country who are dealing with the same problems. The proposal does not just equate an administrative undertaking therefore but rather reimagines urban spaces as dynamic, inclusive ecosystems where people thrive, cultures flourish, and nature coexist harmoniously. As Pune embraces this vision, it paves the way for a more vibrant, resilient, and equitable future.

Why Bengaluru is a Goldmine for Real Estate Investors: Insights and Strategies

Bengaluru, often referred to as the Silicon Valley of India, is rapidly emerging as a prime destination for real estate investments. Its robust infrastructure, thriving IT sector, and dynamic urban development have made it a magnet for both domestic and international investors. Let’s delve into why Bengaluru’s real estate market is booming and uncover the top five tips to maximise your investment returns.

The Booming Bengaluru Real Estate Market

Bengaluru’s real estate sector has shown exponential growth, driven by a steady demand for both residential and commercial properties. The city’s continuous expansion and modernisation efforts have led to significant price appreciation, making it a lucrative market for real estate investment. According to recent data, nearly 200,000 residential units were sold in the first three quarters of 2023 alone, highlighting the strong investment sentiment and promising future supply.

Top Five Investment Tips for Profit in Bengaluru Real Estate

To make the most out of the thriving Bengaluru real estate market, here are five expert tips:

- Invest in the Premium Segment

Premium properties in Bengaluru are less affected by market fluctuations and have shown consistent growth. Investing in high-end residential or commercial spaces can yield substantial returns due to their steady appreciation and demand among affluent buyers and tenants.

- Explore Plotted Developments in Emerging Micro-Markets

Areas like Devanahalli and Sarjapur are emerging as hotspots for real estate investments. These regions offer plotted developments that promise long-term appreciation. As infrastructure projects and connectivity improve, these micro-markets are set to become major growth drivers in the real estate sector.

- Prioritise Connectivity

Connectivity is a crucial factor in determining property value. Regions such as Whitefield, Sarjapur, and North Bengaluru are witnessing tremendous demand due to their excellent connectivity to major IT hubs and business districts. Properties in well-connected areas are likely to appreciate faster and attract higher rental incomes.

- Research Developer Profiles

Before making an investment, thoroughly research the developer’s profile and their track record. Properties developed by renowned builders tend to have higher capital appreciation due to their reputation for quality construction, timely delivery, and better amenities.

- Focus on Sustainable Features

Investing in properties with sustainable features can yield better profits in the short, medium, and long term. As the demand for eco-friendly and energy-efficient homes grows, properties with green certifications and sustainable amenities are likely to command higher resale values and attract environmentally conscious buyers.

The Rise of REITs: High-Yield, Low-Risk Investment Tools

Real Estate Investment Trusts (REITs) have emerged as a popular investment vehicle for retail investors looking to enter the real estate market with lower risk. REITs allow investors to purchase shares in income-generating properties, such as office buildings and commercial spaces, offering high yields and diversified risk. Bengaluru’s office market, which saw a record 58.2 million square feet of gross absorption in 2023, provides an excellent opportunity for REIT investors. The city’s robust demand for office spaces ensures stable rental income and potential capital appreciation.

Exploring Alternative Real Estate Investments

Beyond traditional residential and commercial properties, several alternative investment options are gaining traction in Bengaluru:

- Co-working Spaces: The rise of the gig economy and remote work has spurred demand for flexible office solutions. Investing in co-working spaces can yield high returns as more businesses and freelancers seek affordable and versatile working environments.

- Co-living Spaces: With a large influx of young professionals and students, co-living spaces offer affordable, community-oriented housing solutions. These properties are in high demand and can generate substantial rental income.

- Senior Living: An ageing population has created a niche market for senior living communities. These properties offer specialised amenities and healthcare services, attracting a steady stream of residents and ensuring long-term profitability.

- Fractional Ownership: This innovative investment model allows multiple investors to co-own high-value properties. Fractional ownership reduces individual investment risk and enables participation in premium real estate segments.

Conclusion

Bengaluru’s real estate market is brimming with opportunities for savvy investors. The city’s strong fundamentals, coupled with strategic investments in premium segments, emerging micro-markets, and properties with sustainable features, promise substantial returns.

Additionally, the rise of REITs and alternative investment options like co-working and co-living spaces provide diverse avenues for profit. By following these expert tips, investors can navigate the dynamic Bengaluru real estate landscape and capitalise on its growth potential.

Investing in Bengaluru’s real estate is not just about buying property; it’s about strategically positioning oneself in a market that’s set for continued growth and development. With thorough research and smart choices, you can reap significant benefits from this vibrant and promising real estate market.

Unlocking Real Estate Investment: The Emergence of Small and Medium REITs in India

Real estate has long been a preferred investment avenue for many Indians, who often prioritise property ownership over financial assets like stocks, bonds, or mutual funds. However, the high capital requirement has kept many potential investors at bay. Enter fractional ownership and the recent amendments by the Securities and Exchange Board of India (SEBI), which are set to revolutionise the landscape of real estate investments through the establishment of Small and Medium Real Estate Investment Trusts (SM REITs).

What is Fractional Ownership?

Fractional ownership refers to dividing the value of an asset among multiple investors, each holding a share of the property. In India, this concept is gaining traction in the real estate sector, particularly for commercial properties. Fractional ownership allows individuals with limited resources to invest in high-value real estate by pooling their money with other investors through fractional ownership platforms (FOPs). This democratises access to real estate investments, making it feasible for a broader range of investors.

The Role of SM REITs

The recent amendment to the Real Estate Investment Trusts Regulations, 2014 by SEBI introduces the concept of SM REITs. These trusts are designed for smaller investment amounts, ranging from Rs 50 crore to Rs 500 crore. This move is aimed at bringing the largely unregulated FOPs under a formal regulatory framework, ensuring greater transparency and investor protection.

The key objective of the recent SEBI notification of SM REITs is getting fractional ownership platforms into the regulatory framework. The new guidelines provide a platform for FOPs to exist through the formation of REITs and, more importantly, bring full transparency to investors in terms of disclosure and governance.

Benefits of Investing in SM REITs

Investing in SM REITs offers several advantages:

- Accessibility: With lower minimum investment requirements, SM REITs make real estate investments accessible to a larger pool of investors.

- Transparency: The regulatory framework ensures that investors receive comprehensive information about the assets, reducing the risk of fraud.

- Liquidity: Once listed on stock exchanges, SM REITs will provide investors with the opportunity to buy and sell their shares, enhancing liquidity compared to traditional real estate investments.

Key Considerations Before Investing in FOPs

While SM REITs and FOPs open new doors for investors, due diligence is crucial. Here are some essential factors to consider:

- Minimum Investment Amount

Different FOPs have varying minimum investment amounts. It’s important to assess these requirements to ensure they align with your financial capabilities and investment goals.

- Lock-in Period

Investments in fractional ownership properties often come with a lock-in period, during which you cannot liquidate your investment. This period can vary depending on the FOP and the specific property. Understanding the lock-in period is vital to ensure it matches your liquidity needs.

- Asset Details

Investors should thoroughly evaluate the details of the properties being invested in. This includes the type of property (residential or commercial), location, and whether it is a completed and revenue-generating asset. According to SEBI regulations, SM REITs must invest at least 95% of the scheme’s assets in completed and revenue-generating properties, providing a safeguard against investment in high-risk, under-construction projects.

- Tenant Profile

The potential for rental income is a significant factor in real estate investment. Examining the tenant profile helps ensure steady rental income and reduces the risk of defaults. Reliable tenants contribute to the overall stability and profitability of the investment.

Conducting Due Diligence

Experts say, it’s essential to recognise that the landscape and regulations surrounding fractional ownership are still evolving. Comparing this sector to the well-established mutual fund industry may not be entirely justified. They further advise investors to carefully review terms and agreements and seek assistance from legal or subject matter experts to understand the implications of each clause.

Making an Informed Decision

Investors should consider the properties held by the REIT, the track record of fund managers, and the marketability of the properties. It’s crucial to understand the structure adopted by the FOP to ascertain investor rights, risks, and protection measures.

Conclusion

The introduction of SM REITs marks a significant milestone in India’s real estate investment landscape. By formalising and regulating fractional ownership platforms, SEBI’s new guidelines offer a transparent, accessible, and potentially lucrative investment avenue. However, as with any investment, thorough research and due diligence are imperative to maximise benefits and minimise risks. With the right approach, SM REITs and FOPs can provide a gateway to real estate wealth for a broader spectrum of investors.

The Evolution of Luxury Housing: Today’s Homebuyers Seek Holistic Lifestyles

In recent years, the luxury housing market in India has experienced a remarkable transformation. Today’s discerning homebuyers are no longer satisfied with just owning a home; they seek a comprehensive lifestyle that enhances their daily living experience. This shift in preferences has led to significant trends in the luxury real estate segment, with developers keenly attuned to the evolving needs and aspirations of their clientele.

Surge in Luxury Housing Market

The luxury housing market, defined by units priced at Rs 4 crore and above, has shown robust growth. According to a recent CBRE report, there was a 10% year-on-year sales growth in the first quarter of 2024. Additionally, new launches in the luxury segment surged by an impressive 64% year-on-year during the same period. This growth is particularly pronounced in metropolitan areas, with Mumbai leading the charge with a 15% increase in unit sales, followed by Delhi-NCR, Hyderabad, and Pune.

Key Trends Shaping Luxury Housing

Several key trends have emerged, shaping the luxury housing segment and reflecting the aspirations of modern homebuyers.

- Well-Thought Grand Living Spaces

Today’s homebuyers prioritise spacious residences that offer ample room for both living and leisure. Luxury housing projects are now designed with expansive living spaces characterised by thoughtful designs that prioritise comfort and elegance. These grand living spaces cater to the desire for a home that can accommodate both personal relaxation and social gatherings.

- Distinctive Architecture and Green Spaces

Distinctive architectural designs and abundant greenery are now hallmark features of luxury housing projects. Homebuyers are increasingly drawn to residences that not only offer aesthetic appeal but also promote a sense of serenity and well-being. Lush green landscapes and open spaces are essential components, providing a tranquil environment amidst urban settings.

- Wellness Amenities for a Healthy Lifestyle

The emphasis on health and well-being has led to the integration of wellness amenities within luxury housing complexes. State-of-the-art fitness centres, spa facilities, and yoga studios are now common features, catering to the holistic lifestyle needs of residents. These amenities offer convenient access to health and wellness activities, promoting a balanced and healthy lifestyle.

- High-End Modern Amenities

Luxury is synonymous with comfort and convenience, and today’s homebuyers expect nothing less. Modern luxury housing projects boast a range of high-end amenities, including smart home technology, concierge services, and 24/7 security. These features enhance the living experience, providing residents with unparalleled comfort and convenience.

- Sustainable and Smart Homes

Sustainability has become a fundamental consideration in luxury housing. Developers are increasingly adopting sustainable building practices and incorporating energy-efficient features into their projects. Additionally, smart home technology is becoming ubiquitous, allowing residents to control various aspects of their home environment with ease. This focus on sustainability and smart technology reflects a commitment to creating homes that are both eco-friendly and technologically advanced.

- Exclusivity and Privacy of Gated Communities

Gated communities offer a sense of exclusivity and security, making them highly desirable among luxury homebuyers. These communities provide a sanctuary away from the hustle and bustle of city life, allowing residents to enjoy privacy and tranquillity. The exclusivity of gated communities also fosters a sense of community among residents, enhancing the overall living experience.

Expert Insights on Luxury Housing Trends

Industry experts have observed and commented on these emerging trends, providing valuable insights into the evolving luxury housing market.

- Evolving Concept of Homes: In the views of veterans, the concept of a home has evolved beyond a mere dwelling; it is now seen as a means to enhance one’s lifestyle, with the address serving as a style statement.Buyers now expect luxurious interiors along with high-end amenities and facilities that foster community living.

- Developer Feedback Loop: Developers have responded to this growing demand by launching new properties that cater to the evolving tastes of the urban elite. From strategically-located ultra-luxury apartments to sprawling villas and farmhouses, the luxury housing segment offers a diverse range of options to suit varying preferences. Furthermore, luxury homes with high ROI potential have emerged as attractive investment instruments.

- Other Factors: The need for larger homes in the post-pandemic era, favourable exchange rates attracting investments from NRIs, and the desire to lead a premium lifestyle are key drivers. India’s robust economic growth and positive global market performance have bolstered purchasing power, particularly in metro cities, further fuelling demand for luxury residences.

The Future of Luxury Housing

With the Indian economy expected to perform well in the coming years, the luxury real estate segment is poised for continued growth and innovation. Developers are keen to cater to the sophisticated tastes of modern homebuyers, offering not just a place to live but a lifestyle to aspire to. The focus on holistic living, sustainability, and advanced technology ensures that the luxury housing market will continue to thrive, providing homebuyers with residences that are both exquisite and functional.

In conclusion, the luxury housing market in India is evolving rapidly, driven by the changing preferences of discerning homebuyers. The emphasis on grand living spaces, distinctive architecture, wellness amenities, high-end conveniences, sustainability, and exclusivity reflects a shift towards a holistic lifestyle. As developers continue to innovate and cater to these demands, the future of luxury housing looks promising, offering unparalleled living experiences to those seeking more than just a home.

The Booming Luxury Real Estate Market in India: Trends, Drivers, and Future Prospects

India’s real estate market is undergoing a dramatic transformation, with the luxury housing segment experiencing an unprecedented surge in demand. Rising incomes, growing aspirations for upscale living, and a preference for modern amenities have propelled this transformation, resulting in a boom in luxury home sales across the country. Let’s delve into the factors driving this trend and what the future holds for luxury real estate in India.

A Surge in Demand: The Numbers Speak

India’s luxury real estate market is on an upward trajectory. In a recent highlight, DLF, the country’s largest developer, sold out 795 apartments worth Rs 5,590 crore within just three days of launching its latest luxury housing project in Gurugram. This follows the success of previous projects like ‘The Arbour,’ which saw pre-launch sales worth Rs 8,000 crore in a similar timeframe.

According to recent surveys, the share of luxury homes sold in India has tripled over the past five years. Luxury properties now constitute 21% of all residential units sold across the top seven Indian cities in the first quarter of 2024, up from 7% in 2019. This shift is not just in the numbers but reflects a deeper change in the preferences of homebuyers.

The NRI Influence

Non-resident Indians (NRIs) have played a significant role in driving the luxury housing market. NRIs now account for nearly a quarter of total residential sales at major developers. The allure of luxury properties, coupled with exclusivity and modern amenities, has attracted both domestic and international buyers. This trend underscores the growing global appeal of India’s luxury real estate market.

Changing Preferences: From Affordable to Luxury

Interestingly, luxury home sales have surpassed those of affordable housing units, signalling a shift in buyer preferences. Affordable housing units, which once dominated the market, have seen a decline in sales share from 37% to 18% over the past five years. In contrast, the mid-range and premium housing segments maintain dominance with a 59% share.

Economic Momentum and Wealth Creation

India’s economic growth and the projection of a doubling of affluent individuals within three years have created a favourable environment for luxury real estate investment. Investing in luxury real estate offers not only opulent living spaces but also enduring value and potential long-term returns. The concentration of wealth among high-net-worth individuals (HNIs) has fuelled demand for exclusive properties, particularly in prime locations such as Delhi-NCR, Mumbai, Pune, Hyderabad, and Bangalore.

Investment Potential and Market Projections

Luxury properties have historically exhibited lower volatility and served as a hedge against inflation, making them an attractive asset class for sophisticated investors seeking prestige and profit. Industry analysis projects an 8-10% increase in property prices across key cities over the next two years, further solidifying the long-term investment potential of luxury real estate. This projection aligns with the prevailing sentiment among affluent investors, as evidenced by a recent survey where 56% of HNIs and ultra-high-net-worth individuals (UHNIs) anticipate a reduction in interest rates by the Reserve Bank of India in 2024.

Premiumisation: The Trend Driving Demand

A significant factor contributing to this surge is the prevailing trend of ‘Premiumisation’. With rapid wealth creation and pent-up demand from the COVID-19 pandemic era, consumers are increasingly drawn to luxury products and experiences. This trend extends to the real estate market, where high-net-worth individuals are diversifying their portfolios by investing in luxury properties. Another recent survey found that 75% of ultra-high-net-worth individuals are bullish on real estate, with 61% eyeing ultra-expensive houses.

The Scarcity of Upscale Apartments

The shortage of upscale apartments in prime locations is another driving force behind the luxury housing boom. Cities like Gurgaon are witnessing a scarcity of luxury housing options, leading affluent buyers to seek exclusive properties with modern amenities and sophisticated designs. The shift from traditional bungalows to posh apartments reflects changing preferences among high-net-worth individuals, who prioritise factors such as security, convenience, and exclusivity.

Regional Dynamics

Among the top seven Indian cities driving the demand for luxury homes, the National Capital Region (NCR) and the Mumbai Metropolitan Region (MMR) stand out. In the NCR, luxury homes accounted for 39% of all residential units sold in the first quarter of 2024. Similarly, the MMR has become a hotspot for luxury housing, attracting buyers seeking premium properties and world-class amenities. Other cities like Hyderabad, Bangalore, Pune, Chennai, and Kolkata also have strong demand for mid-to-high-end properties, reflecting diverse regional dynamics.

Conclusion: The Future of Luxury Real Estate

The shift towards luxury real estate is expected to continue, with launches in the affordable segment projected to remain muted. Premiumisation, coupled with rising per capita incomes, is anticipated to drive 10-12% volume growth for large, listed residential developers in the current financial year. As India’s economic momentum continues and wealth creation accelerates, the luxury real estate market is poised for sustained growth, offering both opulent living spaces and robust investment opportunities.

Recounting the Saga of Milestones Achieved In Pune Housing Market In 2024

The Indian real estate sector has been making waves in recent years, with the Pune market witnessing a fascinating upward trend. Ranked as ‘the most liveable city’ in India several times, the city is a unique composite of cultural richness, supreme infrastructure, and a booming IT and commercial hub. Apart from these factors, the city in and of itself has an inexplicable allure that captures the hearts of anyone who has had the opportunity to live here.

Record Breaking Registrations

It is no wonder then that the year 2024 has brought with it the highest property registrations ever in the city, with an unprecedented 52% year-on-year growth. According to reports by the Maharashtra government’s Department of Registrations and Stamps, the Inspector General of Registration and Controller of Stamp (IGR), in March 2024, 21,744 properties were registered, compared to 14,309 during the same month of the previous year.

The report also noted a substantial increase in stamp duty collection in the month, with Rs 804 crore collected in March 2024, accounting for a 30% increase YoY. In the same year, 17,575 properties were registered, with a collection of Rs 620 crore. This consistent increase in registration and stamp duty collection underlines a pattern of burgeoning supply-demand dynamics, signalling a robust housing market in Pune in the coming years.

Residential Market Trends

While property registrations have inarguably shot up in March 2024, the rise hasn’t been uniform across different demographics, price ranges, and apartment sizes. Let’s delve into some of the patterns that were observed to understand what the future might look like for developers, end-buyers, and investors.

- Price Range:

As per a report by a leading real estate consultancy, residential properties priced between Rs 50 lakh and 1 crore accounted for the highest proportion of registered properties, with 33%. This figure is closely followed by 32% of properties priced between Rs 25 lakhs and Rs 50 lakhs. Homes priced under Rs 25 lakhs also witnessed an increase of 5% this month as compared to 16% in March 2023. - Apartment Size:

In March 2024, apartments ranging from 500 to 800 sq ft commanded a significant market share of 40 percent. Apartments under 500 sq. ft., on the other hand, accounted for 35% of registrations in March 2024, becoming the second most preferred apartment size in the city. Similarly, apartments with an area under 500 sq ft also attracted considerable interest, comprising 35 percent of transactions in March 2024, positioning it as the second most preferred apartment size. During the same period, the market share of apartments exceeding 1000 sq. ft. was 13%, the same as it was the previous year.

- Homebuyer Demographic:

Homebuyers aged between 30 and 45 years make up the prime demographic share of the Pune housing market, representing a notable 52%. Additionally, young buyers under the age of 30 account for 24% of the market share, indicating a significant presence owing to increasing rent, relatively lower EMIs and interest on loans, as well as the rising per capita income of this generation. On the other hand, homebuyers aged between 45 and 60 contribute 18 percent, representing a somewhat smaller but still considerable portion of the market.

Final Thoughts

The city of Pune is currently positioned at a crucial turning point, poised for significant growth in its real estate sector. As evidenced by the data insights above, Pune’s housing market is experiencing a steady ascent, driven by strong demand for homes, competitive pricing, and exceptional infrastructure. Coupled with the city’s thriving economy, these factors create a conducive environment for attracting a surge of high-yield investments in the foreseeable future.

The Rise of Commercial Real Estate in India: A Look at Top Office Markets

The commercial Real Estate Sector in India is experiencing a significant surge in demand, with key office markets witnessing substantial growth. According to recent surveys, cities like Bengaluru, Pune, the National Capital Region (NCR), and Mumbai have seen a remarkable increase in rental rates, signalling a strong rebound from the impact of the pandemic. Let’s delve into the details and understand what’s driving this growth and which markets are leading the way.

The Office Market Landscape in Q1 2024

In the first quarter of 2024, the Asia Pacific region witnessed a notable trend: occupiers showed a willingness to pay higher rents for better-quality workspaces, despite their cost-conscious mindset. Key findings from the office market study include:

- High-quality new office spaces attract up to 20% greater rental premiums than average quoted prices in select premium micro markets.

- Global Capability Centers (GCCs) are driving India’s office space demand, accounting for 37% of total lease activity in Q1 2024.

- Bengaluru and Hyderabad dominated office market activity, accounting for over half of lease and three-fourths of supply in the first quarter of 2024.

- Despite a strong demand-supply equilibrium, vacancy levels remained steady.

- Rental rates surged by up to 8% year-on-year across key markets.

- Global firms captured a significant 61% share in office leasing.

Rental Rises in India’s Leading Office Markets

Rentals in India’s top office markets have increased by 4-8% annually. This growth can be attributed to strong demand and an increase in high-end, quality office supplies. After experiencing a downturn during the pandemic due to low demand, occupant exits, and remote work habits, rentals have bounced back in 2024, nearing pre-pandemic levels.

Reasons for Increased Willingness to Pay

Occupiers are now prioritising sites that are conducive to talent acquisition. India’s excellent office market performance is a result of sustained economic growth and improved occupier confidence. Specific high-performing markets in the top six cities have witnessed annual rental growth of up to 20%.

In reaction to changing market circumstances, office occupiers in India are modernising their cost-cutting methods by adopting the hub-and-spoke model, growing flex space portfolios, and using technology. Suburban and peripheral areas that offer affordability are seeing increased demand, indicating a desire for sub-dollar or near-dollar markets.

Examples of High-Performing Markets

- MG Road, Delhi NCR: 18.2% annual growth.

- SBD 1, Bengaluru: 15.5% annual growth.

- Pallavaram Thoraipakkam Road (PTR) in Chennai: 10.9% annual growth.

City-wise Snapshot

Bengaluru

- In Q1 2024, Outer Ring Road dominated leasing, with North Bengaluru leading in supply, accounting for more than half.

- The Engineering & Manufacturing industry dominated leasing activity, accounting for 39% of the total, thanks to major transactions.

- Rentals were constant, providing occupiers with a variety of options throughout the city.

Chennai

- Office leasing moderated to 1.5 million square feet in the first quarter of 2024, with 47% of demand coming from OMR Zone 1 and MPR micro-markets.

- The Engineering & Manufacturing industry witnessed a 28% YoY increase in leasing activity, outpacing the Technology sector.

- Vacancy levels are likely to stay constant despite strong demand and supply dynamics.

Delhi-NCR

- Gurugram’s Golf Course Extension Road saw the largest space take-up, accounting for 0.7 million sq ft (28% of total leasing).

- Technology firms dominated leasing, experiencing roughly a 3X rise in gross absorption compared to the previous year.

- Vacancy fell, and rentals rose by around 9% in Q1 2024 due to high demand and limited new supply.

Hyderabad

- Space uptake grew 2.2 times in Q1 2024 compared to Q1 2023, driven by the healthcare and technology industries.

- Hi-tec City accounted for 80% of overall office leasing in the quarter.

- Vacancies remained steady despite high demand and supply performance.

Mumbai

- The most active micro-markets were Navi Mumbai and Goregaon/Malad, contributing to about half of total absorption in Q1 2024.

- BFSI players dominated demand with 39%, while Flex space accounted for 15%, exceeding the Technology sector.

- Vacancy levels fell by 460 basis points year on year due to limited new supply and strong demand.

Pune

- The technology sector experienced a strong 3.3X YoY increase, indicating a significant recovery.

- Viman Nagar had the highest leasing rate at 25%, driven by BFSI, Technology, and Engineering & Manufacturing occupiers.

- Most markets had rental growth of 3-5% year on year.

- Vacancy rates rose due to lower space demand and increasing supply infusion.

Flex Spaces and Next Trends

The flex space category has grown dramatically, with 8.7 million square feet leased by 2023. Flex spaces are likely to sustain their momentum in 2024, accounting for 15-20% of total office leasing across the top six cities. This highlights occupiers’ desire for nimble, cost-effective workspace solutions.

Furthermore, new office supply with better construction and high-end facilities are often priced up to 20% more than regular rentals in select premium micro markets.

GCCs and Their Impact

Global Capability Centers (GCCs) are offshore entities set up by multinational organisations to execute a variety of strategic functions. In India, GCCs contributed to 37% of overall office leasing in the March quarter. Forecasts indicate that they will lease 45-50 million square feet over the next two years.

GCCs are preferred by international firms due to India’s cost-competitiveness, IT skills, and ability to innovate at scale. Additionally, India’s startup ecosystem and booming IT industry have made digital skills more accessible in the country, further driving the growth of GCCs and the office market as a whole.